Excel Modeling

Introduction

Lesson Structure

Introduction to Modeling

Modeling refers to using certain inputs and using those inputs to predict and forecast how our desired business metric will perform in the future.

It depends what type of company when you have to do it.

start ups are usually six months to a year out, established company forecast out to a few years

also depends on the metric sales could be a few months out.

models are updated on a ongoing basis, monthly, quarterly, yearly.

Most business forecast their sales booking and financial statements, typically businesses forecast all three:

- Profit and Loss

- Cash Flow Statement

- Balance Sheet.

We will focus on profit and loss statement.

We will go over two approaches to modeling:

Top Down

Bottom Up

Resources on Modeling Financial Statements

We recommend the following websites that layout considerations for making assumptions for financial forecasting.

- Modeling the 3 Financial Statements

- Blog on forecasting taxes and interest rates. Scroll down to the bottom of the page where it talks about interest income.

- Forecasting Revenue and Growth

Top Down

Forecasting model requires careful thinking about which approach you want to take to create the models.

One approach to modeling is top-down. It takes a macro approach to forecasting.

Here, you start with the best estimate of the larger size of the market narrowing down to identify the portion of the market that the company is serving, and then estimate what it will take to capture that portion of the market.

Top-down is a macro approach, but it is less credible and typically adopted when there’s limited historical data.

We’ll next look at an example that shows why this is less credible.

Let’s go to the wecart example.

We start with the online grocery delivery market, which is about $20 billion, and then we start getting into the specifics, such as which market segments the company wants to focus on.

Say the executive team at WeCart wants to retain the focus on the urban market, which is about $17 million. Now, the assumption is that WeCart will aim to capture five percent of this market, and with that we arrive at $850,000.

say $4.95 per delivery, we can now arrive at our sale quantity estimates of about a 170,000 customer orders.

As you can see, this is a less credible way to forecast because you’re talking in guesses and estimates based on macro figures.

It’s harder to convince potential investors you can realistically achieve this forecasted revenue.

Bottom Up

A bottom up approach takes a micro approach to forecasting. The approach starts by looking at historical data. The more data you have, the better.

But often, even as little as six months to one year data is used in this approach.

The model forecasts are based on these data to make assumptions about how the key metrics will behave, and then we forecast out the revenue based on these assumptions.

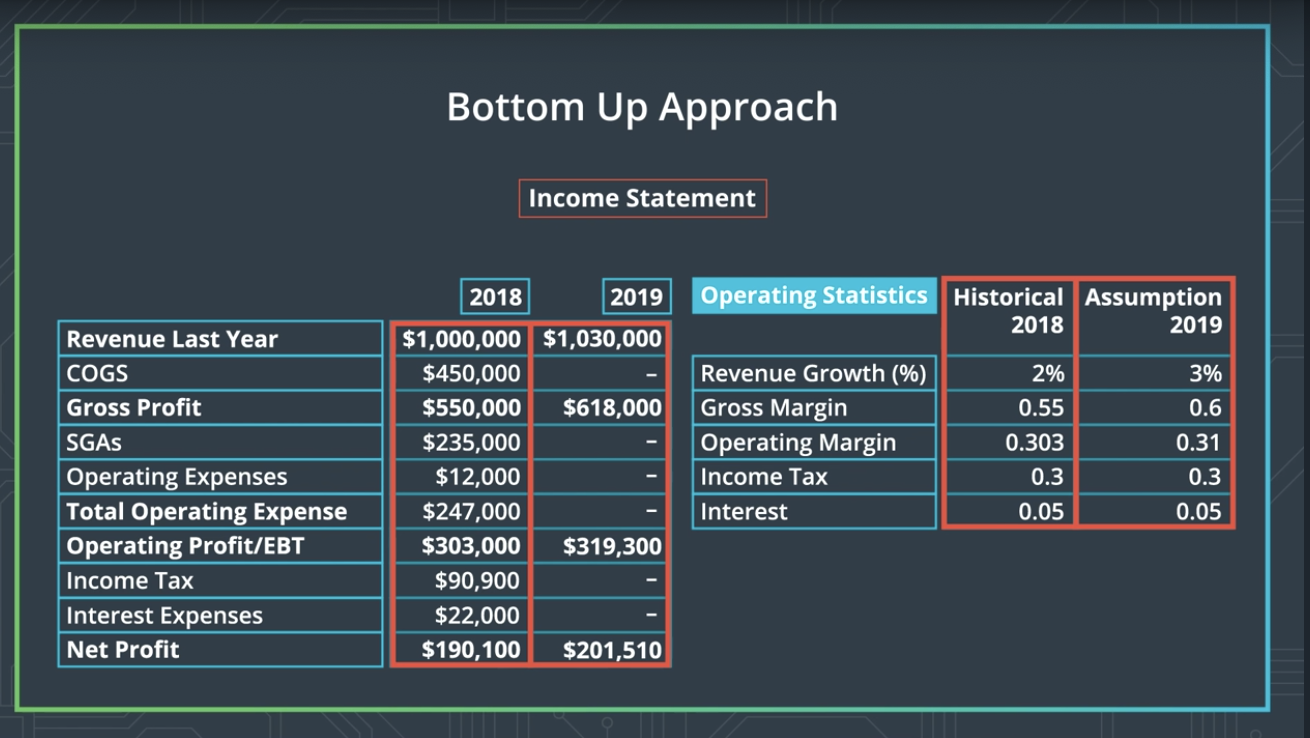

Let’s look at a sample income statement that uses bottom up approach to forecast out revenues and net income.

For instance, we started with the historical data.

For example, last year’s income statement metrics, then we use this historical numbers to calculate out margin metrics as well as historical income tax rates and interest expenses.

The next step is to use those margins and metrics to come up with the assumptions for the future, in this case, the following year.

Finally, using those assumptions in our model, we forecast out the key metrics for next year. As you can see, bottom up approach is based on assumptions as well,

but it is built on previously attained numbers.

There are specific to how the company has performed, and not generalizations that relate to the market as a whole.

Components of a Model

Components of a Forecast Model

- Inputs or Drivers These are the inputs that drive the output of the model.

- Outputs This is the metric being forecasted within the model.

Historical Data and Assumptions

In modeling, assumptions on what you think will come true for the inputs or metrics in the model.

It can be assumptions about the To build your assumptions out,

you start with information available to you based on historical data. For example, we can assume we will continue to gain market share at the same rate as we have for the last six months,

or we a sales around holidays or on certain days of the week. As you make assumptions,

pay attention to your forecasts about metrics you have less control over. Costs are usually harder to change drastically.

So, when you make your assumptions about reducing the future costs, make sure you’re being realistic.

For instance, when estimating the cost of delivery,

the cost of gas is typically harder to predict since gas prices are fairly volatile. So, in general, be careful about the assumptions you make about changes in costs, and check to see if those assumptions are reasonable and make sense.

Historical Data

Historical data is above what’s your metric show for the past. So, for sales, we look at prior sales data from the last year or month.

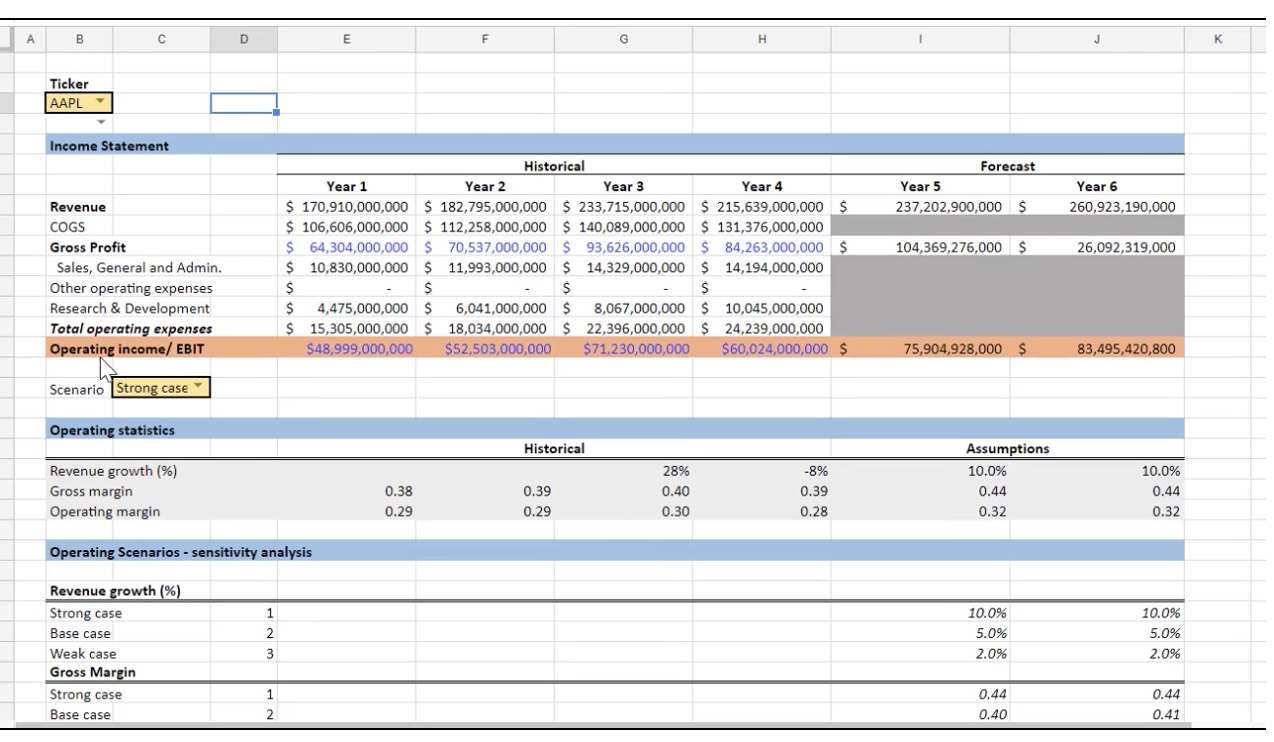

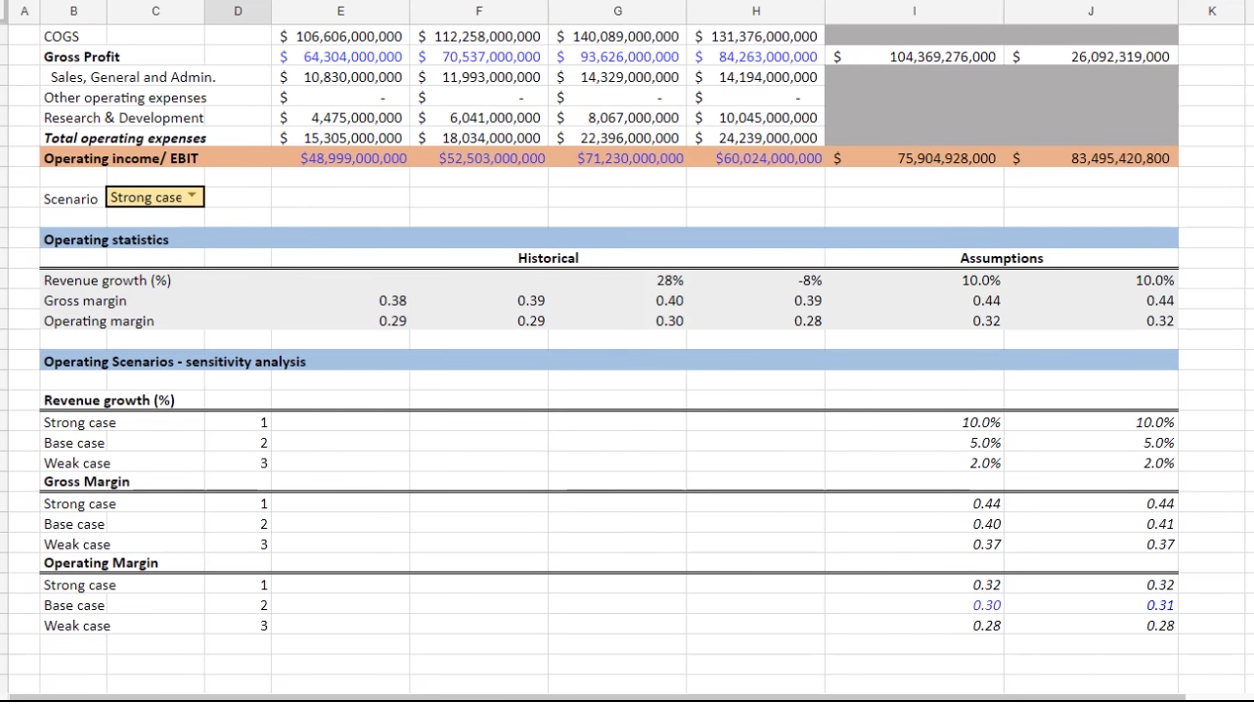

For financial modeling, we look at prior financial statements quarterly or annual results. Here is an example of a financial model.

We’re using these primers data on revenue and COGS to calculate our operating income.

We’re using these primers data on revenue and COGS to calculate our operating income.

We then use our historical data to calculate our assumptions.

Similarly for sales forecasting, we use our prior months’ data on bookings closed in one probability,

and these inputs are used to forecast out our future bookings.

Historical Data

Historical data is about what your performance metrics show for the past. For sales, for example, we look at prior sales data from the previous year or months. For financial modeling, we look at prior financial statements, as well as quarterly and monthly results. Above we are using prior year data (e.g., Revenue, COGS) to get our operating income, which we then use to calculate the historical operating margin.

Formulas for Calculating Historical Financial Metrics

Typically, the historical statistics or metrics used to forecast financial metrics in an Income Statement are:

- Revenue Growth

- Gross Margin

- Operating Margin

- Historical Tax Rate

- Historical Interest Expense Rate

The following list provides more information about calculating the historical statistics.

-

Revenue Growth (in %) = ((Current Year's Revenue / Previous year's revenue) - 1 -

Gross Margin = (1- (Current Year's Cost of COGS/ Current Year's Total Revenue))Keep in mind the two terms COGS and Cost of Revenue can be used interchangeably. -

Operating Margin = Current Year's Operating Income / Current Year's Total Revenue -

Historical Tax Rate is the tax rate from the companies previous year's tax rate. -

Historical Interest Rate is the interest rate coming from the previous year's Debt Schedule.

Additional Resources on Developing Assumptions

We recommend the following websites that layout considerations for making assumptions for financial forecasting.

Sales forecasting

Bottom Up Sales Forecasting

Top Down Sales Forecasting

Bottom Up Sales Forecasting

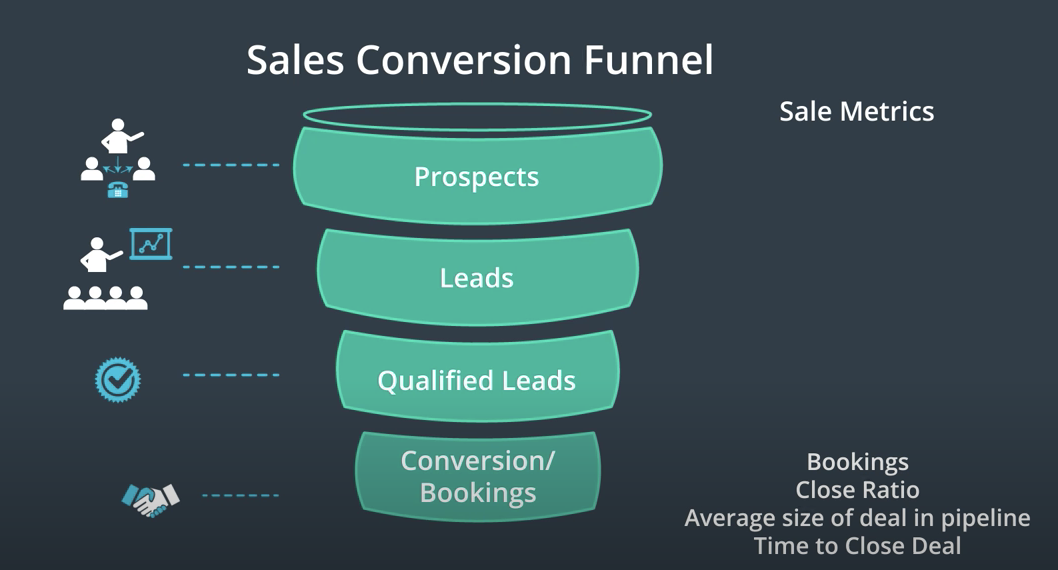

Computed using the sales conversion funnel

Let’s say you’re the sales manager for a company that makes flatware,

say using renewable products like bamboo,

and you’ve been asked to forecast the sales ![]() for the company.

for the company.

Your sales team has several accounts which offer opportunities to make a sales deals, and you’re trying to forecast your sales metrics for the next year.

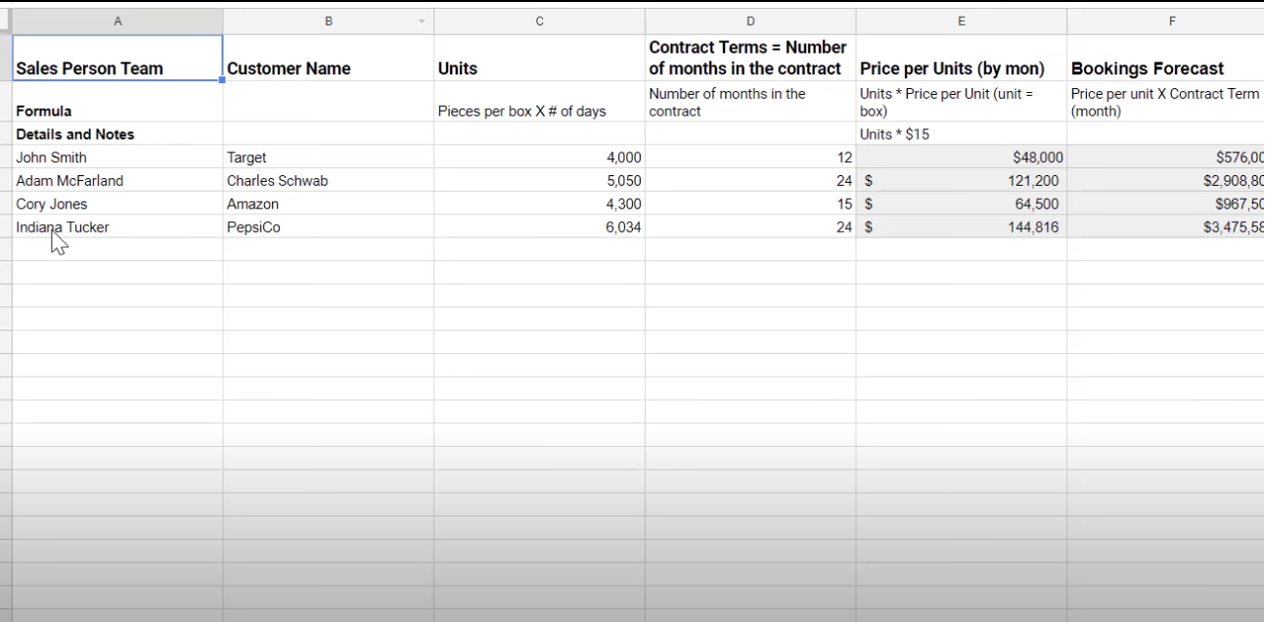

Account refers to the companies where you provide your products in bulk. You’re not selling to the individual customer here, but rather to the company that will buy the products in bulk. Now, let’s go over sales forecast example using a bottom-up approach.

This is the more common approach and it comes from the sales file historical data.

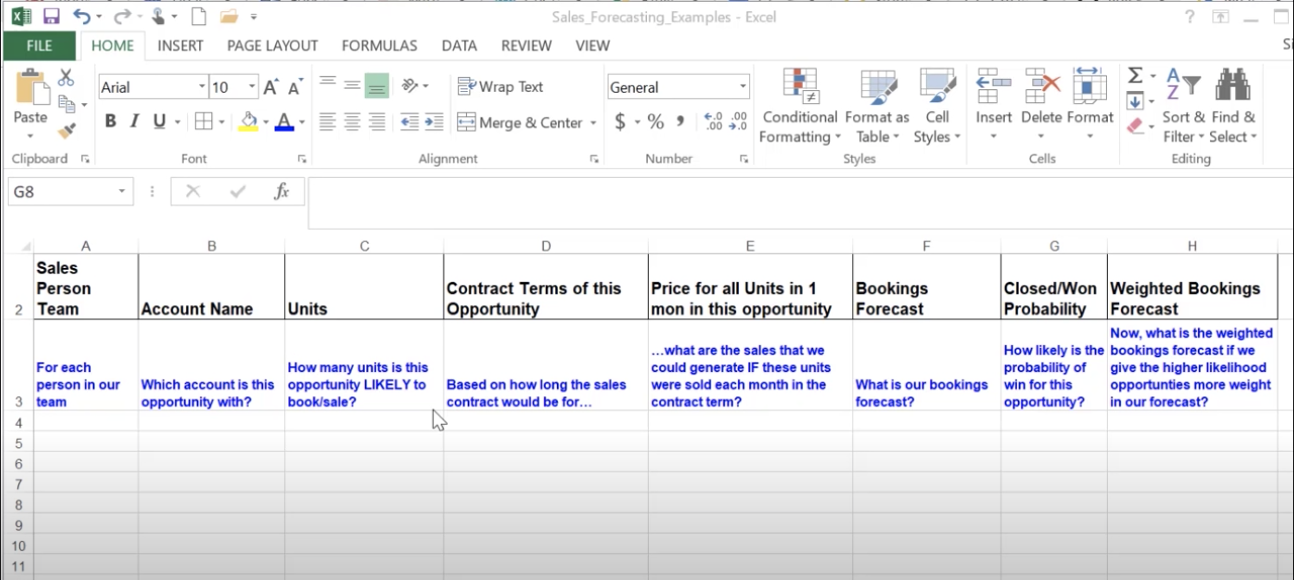

We start with having one row for each person in our sales team.

This is the more common approach and it comes from the sales file historical data.

We start with having one row for each person in our sales team.

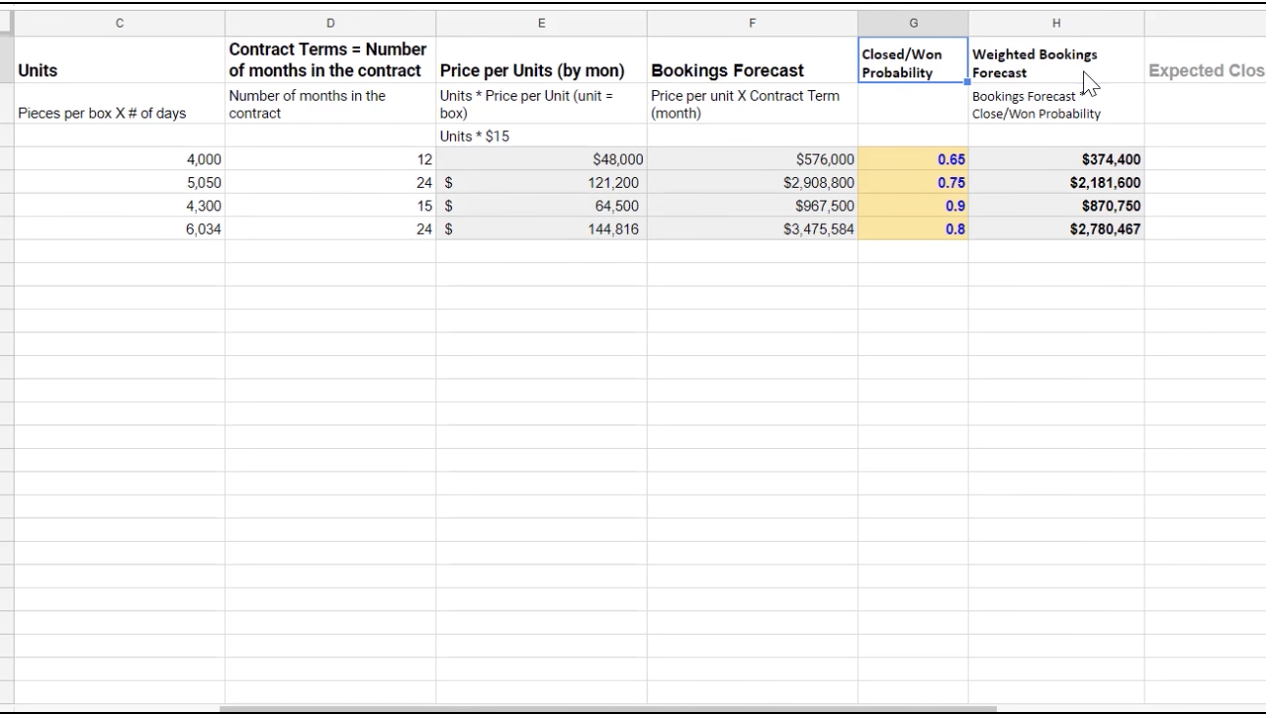

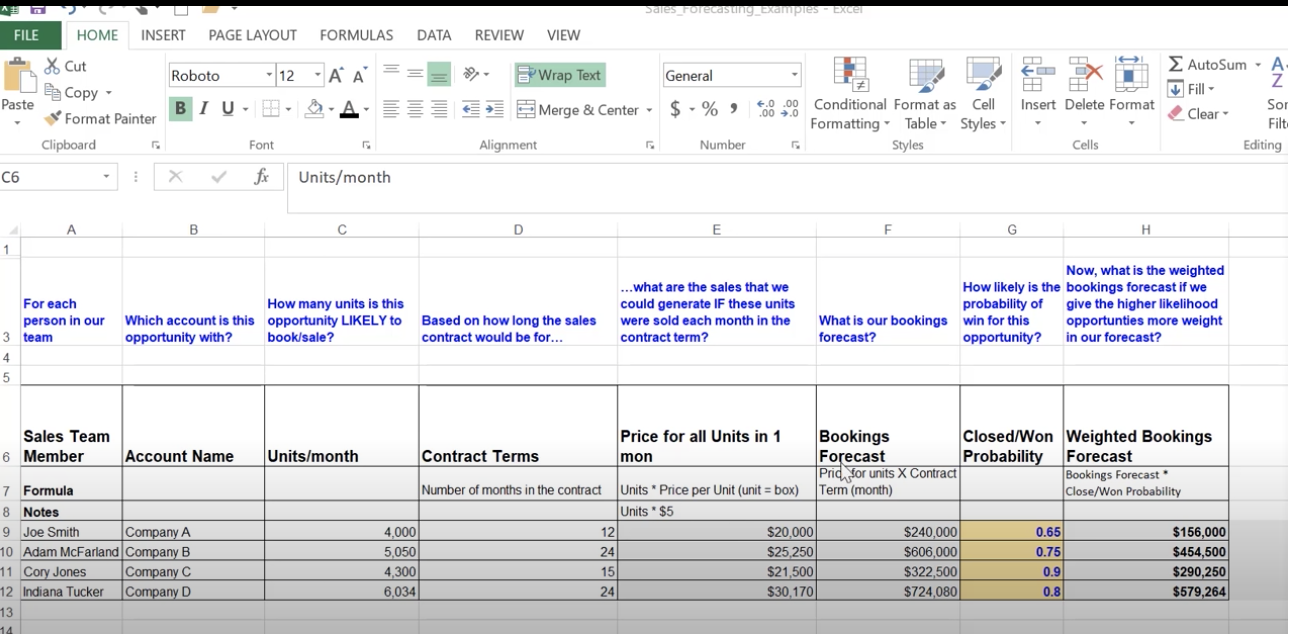

So, in the model, we are trying to understand for each person in our sales team, which account is this opportunity with? How many units is this opportunity likely to create a booking for or sale?

Based on how long the sales contract would be for, what are the sales that we would generate if these units were sold each month in the contract term?

That provides us with our bookings forecast. In column F, we can go one step further and we can ask how likely is the probability of a win for this opportunity? Based on that probability, we can calculate the weighted bookings forecast.

So, let’s walk through the sales model using a bottom-up approach ![]() .

.

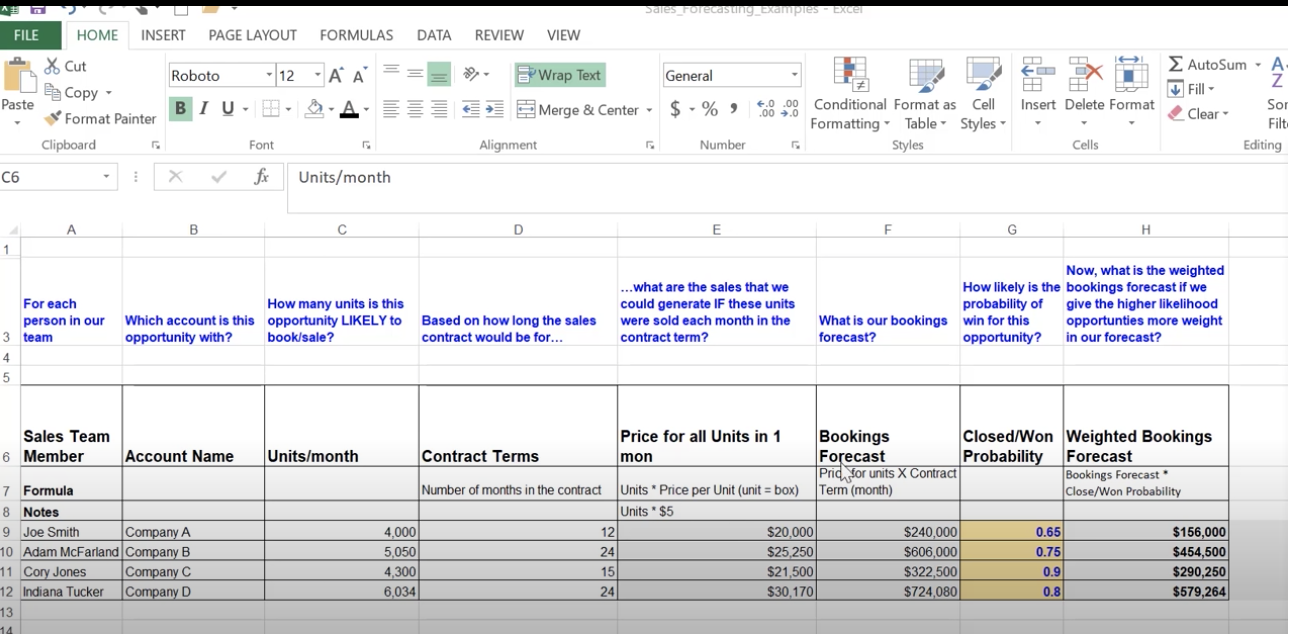

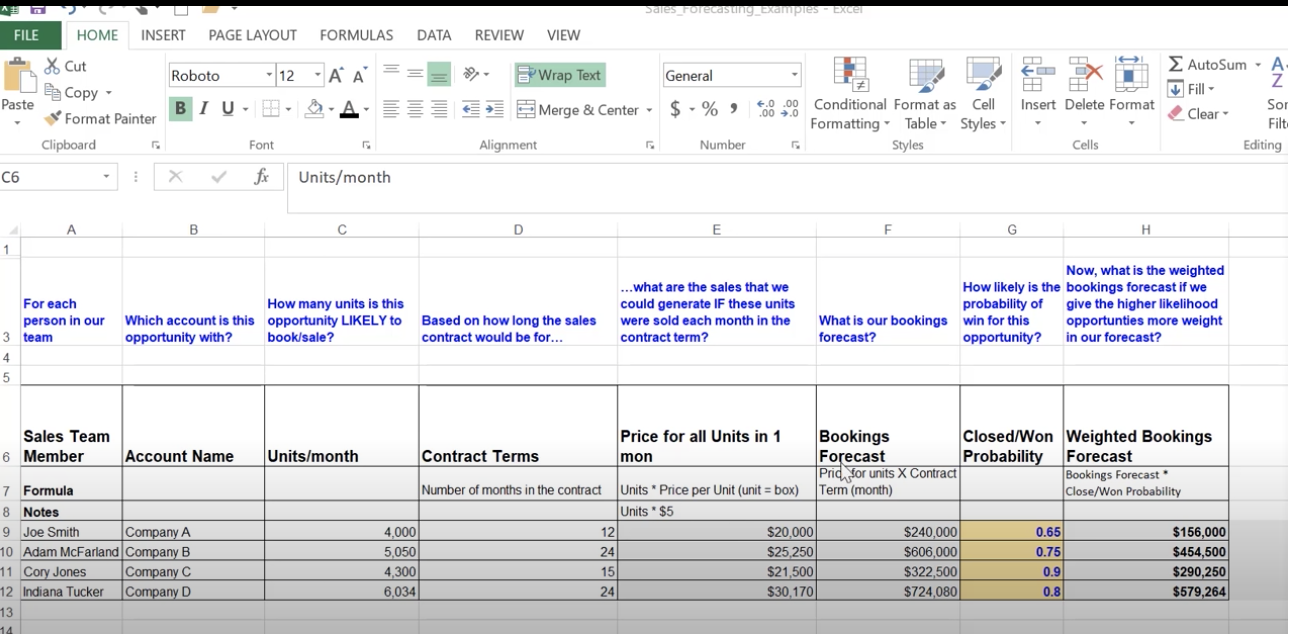

I’ve kept the overarching themes here on the top, so you can see what is the motivation for each of these columns. We start with this column with a row for each sales team member.

This is followed by the company, which is the company name for which you are going to be selling products in bulk, and then comes in column C, the units per month.

So, this is the number of units this opportunity is likely to create a bookings for. Contract terms shows the number of months each opportunity is for. Price for all units in one month shows the number of units times the sales price per unit, which is $5 here, and this is showing the sales price for their projected unit over a month.

For example, how much would Joe Smith, working with company A, bring in revenues from the sale of 4,000 units per month? Then you multiply that with the number of months in the contract term to arrive at the bookings forecast.

We can go one step further and multiply the bookings forecast with the win probability to show a more realistic weighted forecast.

So, let’s look at this example.

We’re more likely to get the sales contract with Corey Jones, Company C,

because it has a wind probability of 0.9,

So, let’s look at this example.

We’re more likely to get the sales contract with Corey Jones, Company C,

because it has a wind probability of 0.9,

versus this ooportunity with Joe Smith Company A, which has a lower probability.

So, the 290k is a weighted bookings forecast, which shows this is a high probability that you’ll win this compared to this one. It takes into account the probability, so you can get a realistic estimate of how likely are we getting this amount versus the amount.

So, this is a bottoms-up sales forecast.

As you can see, here we’re using an opportunity level forecast to project out the bookings for the whole company.

Assumptions and KPIs

Here are the formulas used in the sales forecasting example described in the video above.

Contract Terms = Number of months in the contractPrice per Unit (by mon) = Units needed in 1 month X Price per UnitBookings Forecast = Price per Unit X Contract Term (month)Closed/Won Probability = Probability of Closing the dealWeighted Bookings Forecast = Bookings Forecast * Closed/Won Probability

Additional Resources on Sales Forecasting:

As described in the video, there are several different ways and goal of sales forecasting. The following websites provide more examples of sales forecasting.

- Sales Hacker - Forecasting Methods

- Sales Hacker - Forecasting Metrics

- Insight Squared

- Seismic: Improving sales productivity

Top Down Sales Forecasting

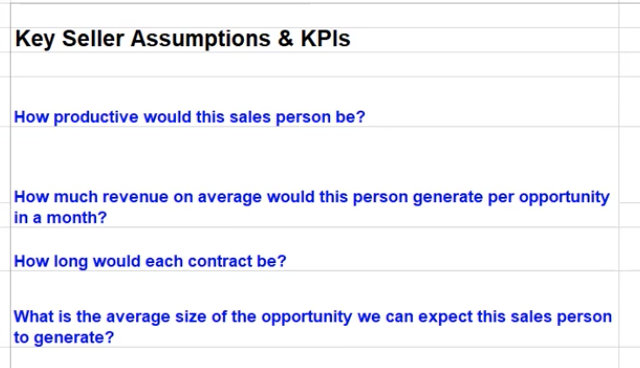

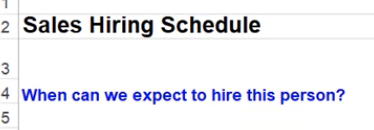

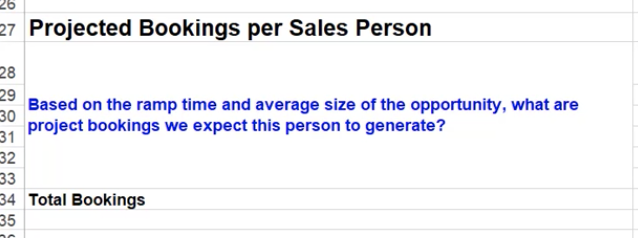

Let’s go over a top-down model that focuses on bookings for sales person.

The model is divided into four portions here. We’re starting with an assumptions about the dollar amount we need in bookings. Then we figured out how much time and effort it would require to get to generate those bookings.

Let’s look at this more closely. We start with an assumption about how productive this sales person who we are going to hire will be.

We measure this in terms of the number of opportunities being generated, and then we look at how much revenue on average would this person generate per unit and per an opportunity.

We use these assumptions to arrive at the average size of opportunity we can expect the sales person to generate.

Then we make assumptions about how much time and effort it will take us to arrive at those bookings.

For this, we project out when we will hire the person. Then based on our sales historical data, we come up with the assumption that a new sales member would take X number of months to get up to speed to start generating those leads and bookings.

Then finally, we use the ramp time and the average size of opportunity assumptions, to project out when he will see the bookings that we expect this person to generate.

As you can see, we get to the final bookings number for each sales team member and month, by starting with our bookings in the more broad sense and then narrowing down to each person and month.

Example Top Down Sales Forecasting

Quiz my solution

Scenario or Sensitivity Analysis

Transitioning to Spreadsheet Tools

To build out the financial model, let’s first take a look at some Excel functions and tools specifically for Financial modeling. As we introduce you to each of these, we will work towards a financial model, so this will set you up nicely for your final project.

-

Data validation is a spreadsheet tool that allows you to limit what values are accepted in a cell. You can create drop-down lists of items, restrict cell value to date ranges and numbers.

-

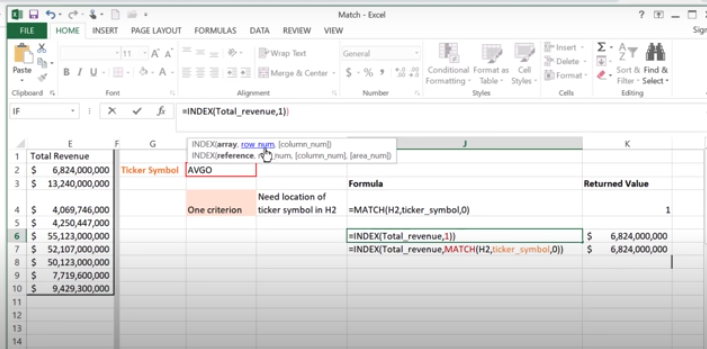

INDEX function is used when you want the cell to have a value chosen from a specified array and row number indicated within the INDEX function.

-

MATCH is a LOOKUP function that can locate the position of the lookup value within an array only when it meets specific criteria defined in the MATCH function.

-

INDEX AND MATCH together add a powerful feature for advanced formulas. Together they can give a value from an array (the purpose of the INDEX function) based on a numeric position (which is provided by the Match function).

-

And finally… OFFSET. Here you can select a start point in the spreadsheet, and tell Excel to return a set of cells that are counted from the starting point. We are going to work through an actual example for each of them in the coming videos.

Data Validation

Excel Steps

Purpose: The purpose of data validation tools is to confirm that the values within the cell are validated against a criterion. In other words, the values within the cell are confined to specific requirements. There are several criteria, including a provided list of values, date range, range of whole numbers or decimal values.

To access the Data Validation tool within MS Excel, you use the Data tab and choose Data Validation.

Google Sheets Steps

Much like MS Excel, you can see the Data Validation options under the Data tab in Google Sheets. See the image below with Data Validation highlighted in gray.

Additional Resource Here is also a link to Google’s support documentation for Data Validation.

Index

Excel Syntax

Purpose: INDEX takes a range of cells and returns a cell from that range that is based on a cell count number provided within the INDEX function.

The following is the generic syntax for MATCH:

INDEX(array, row number, column number)

Once you have entered your formula, instead of hitting enter, you need to press Ctrl+Shift+Enter. This places the curly braces around the formula. Missing this step can cause #NAME? error.

Match with One Criterion

Excel Syntax Purpose: The purpose of the MATCH function is to provide the location of a defined lookup value within a given lookup array.

The following is the generic syntax for MATCH:

MATCH(lookup_value, lookup_array, [match_type])

Match type can vary from 0 (match is an exact match), 1 (match is less than or equal to lookup value), to -1 (match is greater than or equal to lookup value).

Additional Resources to learn about Match Function Here is the Office support documentation to learn more about MATCH function

Google Sheets Syntax Google Sheets uses the same syntax as MS Excel.

Additional Resource Here is the link to the Google support documentation for using MATCH functions in Google Sheets.

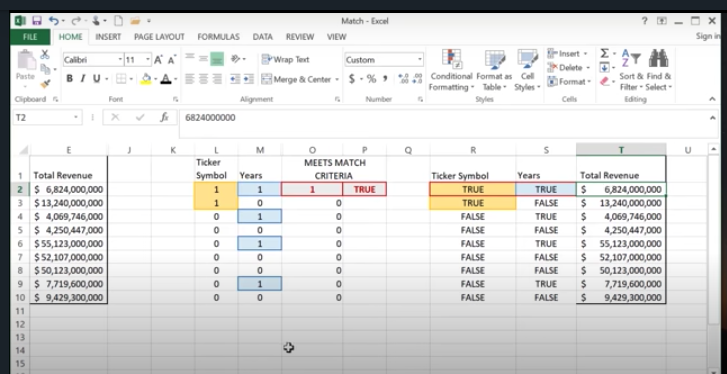

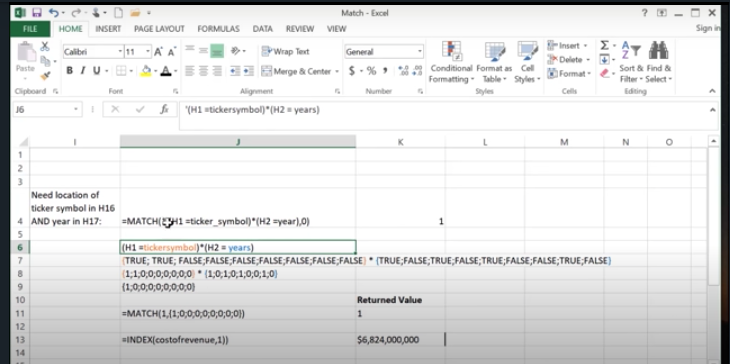

Index and Match with Multiple Criteria

Excel Syntax To combining INDEX and MATCH when you need MATCH to meet multiple criteria, Excel uses boolean logic to create the MATCH criteria. The following is the generic syntax for combining INDEX and MATCH when you need MATCH to meet multiple criteria:

INDEX(array, MATCH(1, (condition 1) x (condition 2), [match_type]))

Google Sheets Syntax Google Sheets uses the same syntax as MS Excel. Once you have entered your formula, you need to press Ctrl+Shift+Enter. This places the formula within an ARRAYFORMULA to execute the function. Missing this step can cause #NAME? error.

Offset

Excel Syntax Purpose: The purpose of the OFFSET function is to return a range that is a specified number of rows and columns from a reference cell or range

OFFSET(cell_reference, number of rows to offset by, number of columns to offset by)

Google Sheets Syntax Google Sheets uses the same syntax as MS Excel.

Additional Resource Here is the link to the Google support documentation for using OFFSET functions in Google Sheets. The four steps to take to create a financial forecast.

-

Step 1

is to calculate

the operating statistics that include the gross and operating margin, and revenue growth.

This is all based on the historical data,

which you can find in the income statement over here.

So, this is step 1.

The first box here.

is to calculate

the operating statistics that include the gross and operating margin, and revenue growth.

This is all based on the historical data,

which you can find in the income statement over here.

So, this is step 1.

The first box here. -

Step 2

is to create the scenarios.

I have them here in this box here.

So, this is the scenario that we are going to be creating.

Typically, we have a strong base and weak case.

Some business analysts choose to have two additional scenarios as well,

we’re going to stick with three cases.

is to create the scenarios.

I have them here in this box here.

So, this is the scenario that we are going to be creating.

Typically, we have a strong base and weak case.

Some business analysts choose to have two additional scenarios as well,

we’re going to stick with three cases.

Correction : In the above videos, the formula in column D is incorrect, and should instead say =$F$7/$E$7 -1.

-

Then come the assumptions as part of step 3

.

These assumptions change in response to the scenario that is chosen over here.

This is where we’re going to use offset.

.

These assumptions change in response to the scenario that is chosen over here.

This is where we’re going to use offset. -

Finally, step 4

may be develop the forecasted scenarios that

change dynamically based on

the scenarios that are chosen because that affects the assumptions,

and the assumptions go inside the forecasted metrics.

may be develop the forecasted scenarios that

change dynamically based on

the scenarios that are chosen because that affects the assumptions,

and the assumptions go inside the forecasted metrics.

Formatting principles for Modeling Here is a guide to best practices for formatting financial models.

- All inputs to the model should be colored BLUE. These include hard-coded values.

- All formulas and calculations should be coded in BLACK.

- Any links to other sheets within the workbook should be coded in GREEN.

- Any links to other files should be coded in RED.

Here is a good website to review the best practices:

Formatting for Financial Modeling

Quiz

Here are the steps I took to solve it…

-

Created a pivot table to filter/remove duplicates in the company list. Name range as company_list. The same step for years.

-

In Data validation sheet I created the drop down using data validation - list - and selected the Pivot sheet’s named range company_list. Same thing for the Scenarios

-

In Match Intro, I experimented with index, match with one criterion and match with two criterion.

Index will return the value of a cell [in the selected array or name range],[row number]

INDEX(array, row number, column number)Match will return the row number of the [lookup_value aka whatever you are trying to match],][lookup_array aka where are you trying to look it up, name range, dragged rows or cols of cells],[1,0(exact match),-1]

MATCH(lookup_value, lookup_array, [match_type])Match with multiple criteria uses boolean logic: Match(1,[condition1]x[condition2],[0]). This will only return the row number of your lookup value.

MATCH(1, (condition 1) x (condition 2), [match_type])Index and Match is a powerful combination. Index will give the value while Match provides the row number.

INDEX(array, MATCH(1, (condition 1) x (condition 2), [match_type])) -

In Dataset I computed the Gross Profit by

COGS-Total Revenue. Operating Income byGross Profit-Total Operating Expenses. Gross Margin by(Total Revenue-COGS)/Total Revenue. Operating Margin byOperating Income/Total Revenue. -

In forecast, I built the Income Statement with pulled historical values using

index and match.In Operating Statistics Revenue Growth % is

(Current Year-Prior Year)/Prior Year. Gross Margin and Operating Margin are pulled from Dataset usingindex and match.In Operating Scenarios - Sensitivity Analysis, there are three cases: Strong, Base and Weak. Each row: Revenue Growth %, Gross Margin, Operating Margin has three cases. Udacity’s Assumptions are given. I did mine by filling the base case first by

average(year2,year3)to get year 4. I added+0.02strong case and subtracted.03for weak caseThen repeat for each row.

-

Use offset in combination with match to pull the value by matching the scenario to the each case under the scenario sensitivity analysis.

OFFSET(cell_reference, number of rows to offset by, number of columns to offset by)and input this to under Operating Statistics Assumptions.

-

To fill the year 4 and Year 5 Income Statement:

Revenue is computed by

Prior Year Revenue*(1+assumption year growth)Gross Profit is computed by

forecast year Revenue* assumption gross marginOperating Income is computed by

forecast year revenue*assumption operating marginAll of them will depend on the Assumptions.